33+ deducting home mortgage interest

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Ad Learn More About Mortgage Preapproval.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

. Web as a deduction for tax year 2017. Web Through April 30 they made home mortgage interest payments of 1220. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web Generally with a loan limit of 750K average loan balance of 850K yields a percentage of approximately 88 of interest that would be deductible. Discover Helpful Information And Resources On Taxes From AARP. Web If your home was purchased before Dec.

Use NerdWallet Reviews To Research Lenders. Browse Information at NerdWallet. 30 x 12 360.

Your New York itemized deduction for the total interest you paid on line 15 is computed using the federal rules that applied to tax. Households claiming the home mortgage interest deduction declined. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Take Advantage And Lock In A Great Rate. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Taxpayers who took out a mortgage after Dec. Divide the cost of the points paid by the full term of the loan in.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web on schedule A the mortgage interest and property taxes are clearly shown I dont understand why it did not carry over to the NY state tax return.

The settlement sheet for the sale of the home showed 50 interest for the 6-day period in May up to but. Homeowners who bought houses before. Web March 4 2022 439 pm ET.

Web IRS Publication 936.

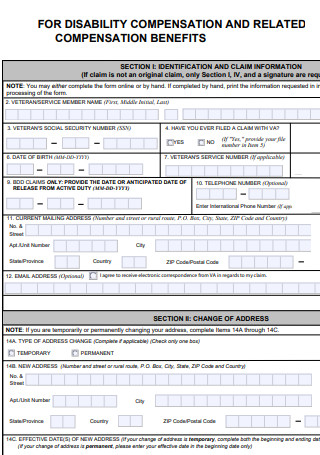

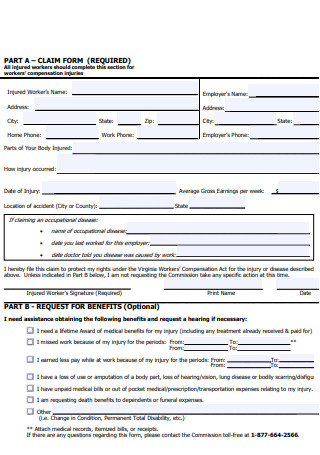

33 Sample Compensation And Benefit Form In Pdf

5 Documents You Need To Save Cash At Tax Time Tips For Home Buyers Tax Time Real Estate Tips Tax

Annual Report 2003 2004

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

What Your Mortgage Interest Rate Really Means Money Under 30

Mortgage Interest Rates Housing Finance Capital Markets Khan Academy Youtube

The Buying Power Of Lower Mortgage Rates The New York Times

Mortgage Interest Deduction Rules Limits For 2023

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Betterment Resources Original Content By Financial Experts App

Tarun K Ray On Twitter Do You Have A Requirement Of Loan Or Credit Card Contact Us Now Email Us Info Sroyps Com Ring 0 91270 66444 Personal Loan Pl Business Loan Bl Bt Top

33 Sample Compensation And Benefit Form In Pdf

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Top 33 Ecommerce Marketing Case Studies You Need To Swipe Sugatan Io

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service